Turn your daily steps into automatic savings.

My Role

Product Designer, Product Illustrator

Timeline

12 Weeks, 2025

Focus

Product Design, UX Research, Visual and Icon Design

Problem

Core Experiences

People want to save money, but most tools don’t fit into everyday life.

Saving apps take effort, and step apps rarely turn movement into real savings. When saving happens in the background without being felt, people lose interest and stop.

WalkFund is the only saving product that turns everyday walking into automatic savings tied to personal goals. (0→1 product concept)

Step-Triggered Savings with Financial Safety

WalkFund never stores money. Savings run through Apple Pay, PayPal, or Cash App.

When a step goal is met (e.g., 1,000 steps = $1), a small transfer will be triggered, keeping all savings secure within trusted accounts.

Start at Small, Achievable Savings Goals

WalkFund makes daily steps a small push toward savings goals.

4 steps to set your goal, helping users build a saving habit without pressure or financial overwhelm.

Reach Your Amount and Your Goal

WalkFund celebrates users when they reach their target amount.

The system helps scheduled goals on track with automated recommendations to help users follow through.

Redeem a Nearby Reward

WalkFund offers local rewards that encourage users to walk and explore new neighborhoods.

Community collaboration with partner shops, turning city walks into small moments of delight and neighbor connection.

Ask WAI, Your Smart Saving Companion

WAI helps users make saving and lifestyle decisions confident and transparent.

WAI acts as a light financial and wellness advisor, turning your Why into an answer.

Icon System Snapshot

Icon system designed to reinforce meaning across navigation and feedback states. (Details are covered later in the case study.)

Design Journey

Research

What existing products get wrong

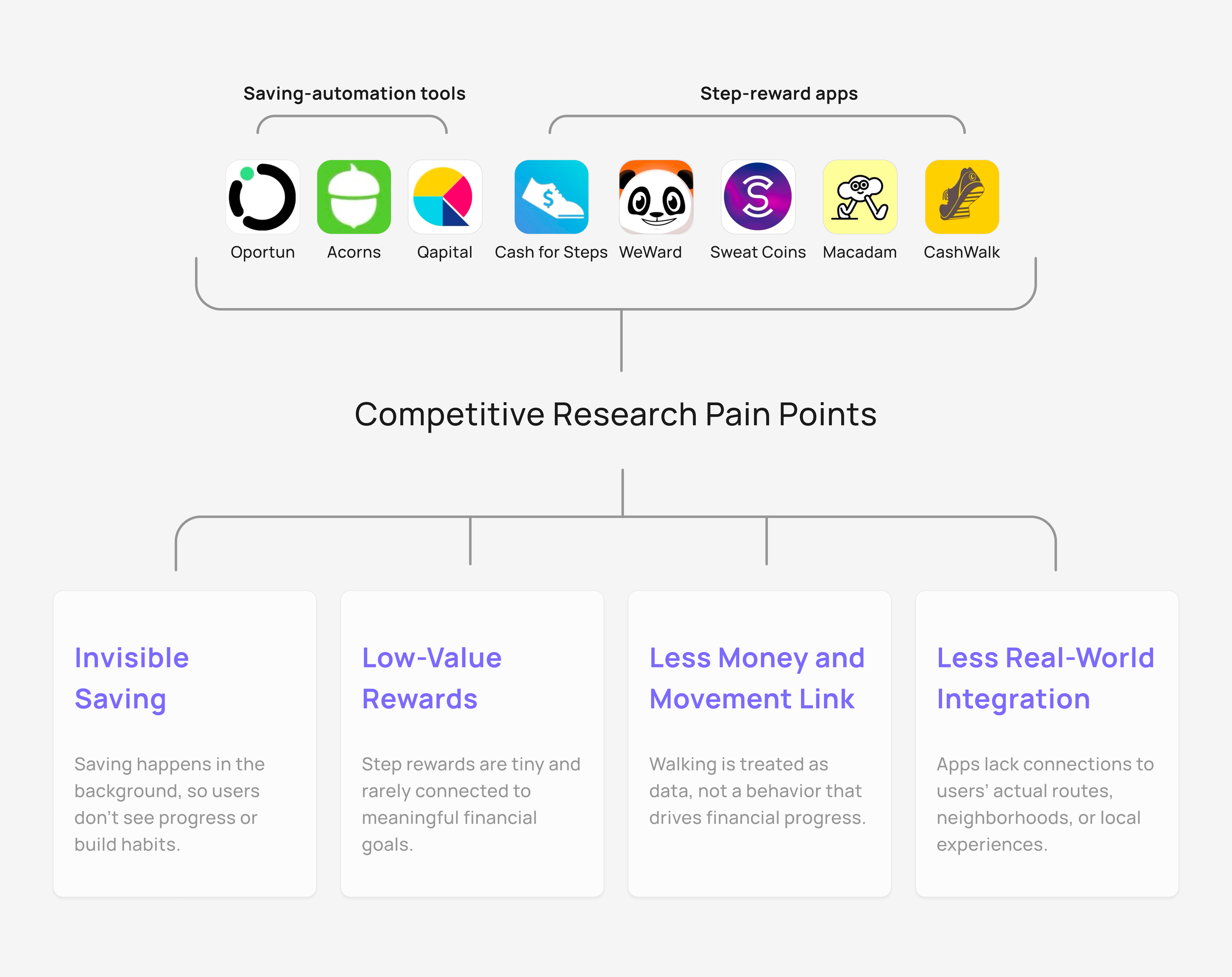

Most fall into two patterns:

Automation tools make saving intangible, running quietly behind rules and dashboards.

Step-reward apps offer tiny, generic perks with little connection to real financial goals.

Interviews

Interviews with 6 young adults (22-35) in New York:

They want financial stability, but current tools fail to connect saving with their daily lives.

Rewards alone didn’t motivate behavior, but meaning and visibility did.

Synthesis

Key Insights

While walking already carries emotional and lifestyle meaning, saving often feels abstract, or difficult to sustain. Synthesizing both research streams, we identified five key insights:

Design Principles

Then, we can uncovered 5 opportunities of our product:

Make saving feel safe, automatic, and low-pressure

Turn everyday walking into visible, real savings

Set rewards in real city life, not abstract points

Target Users

To focus our opportunity spaces into a clear product direction, I narrowed WalkFund’s audience.This spectrum revealed distinct behavior patterns that shaped WalkFund’s core archetypes.

Here are two dominant groups:

Life-driven who seek meaningful walking moments

Finance-driven who prioritize efficiency and tangible results.

These formed our two personas.

Business Strategy

Why Walking and Saving?

Walking already feels meaningful. Saving often does not.

Behavioral Economics shows that when financial goals are reframed into small, familiar actions, people feel more motivated and confident. (Berkeley Economic Review).

Likewise, research on the Automatic Savings suggests that micro-contributions reduce friction and boost long-term saving behavior (Hershfield, Shu & Benartzi, 2018).

WalkFund brings these theories together by converting daily steps into automatic, visible micro-savings.

If you walk 1,000 steps, then $1 is saved.

Simple, tangible, and emotionally rewarding.

How These Tie Into Strategy

Taken business goals, research insights, and user benefits together to define WalkFund’s strategic priorities:

❇️ ❇️ ❇️ Trust, build trust as the foundation

❇️ ❇️ Motivation, make saving feel motivating and achievable

❇️ Lifestyle Value, deepen daily engagement

These priorities guided all core system decisions.

System Map

Building Trust into the System

Walking triggers micro-savings, trusted payment flows keep users confident, and rewards keep them motivated.

System overview: how WalkFund maintains trust without holding user funds

Design Concept

Ideation to Final MVP Directions

Then, I generated 50+ feature ideas and narrowed them through structured filters.

To ensure our MVP solved the core user problems, I grouped all ideas into four strategic directions:

Micro-goals Setting — Motivation

Nearby Rewards — Motivation

Progress Visualization — Lifestyle Value

AI Savings Assistant (Personalized Help) — Lifestyle Value

Design Exploration

The sketch quickly visualized how WalkFund could unify trust, micro-saving, and lifestyle motivation. These explorations helped shape the core features.

User Journey

Then, I mapped journey to illustrate how WalkFund’s core features work together and why the MVP set effectively supports both finance-driven and lifestyle-driven users.

Initial Wireframes

1. Set a Goal

Users create small saving targets tied to walking behavior and see the process data clearly.

2. Complete a Goal

A simplified flow reinforces achievement and suggestion.

3. Redeem a Reward

Users can find nearby coupons, closing the motivation loop.

Tests and Iterations

Tested 18 participants across in-person with Figma and remote with Useberry

(Round 1: n=9, Round 2: n=9, Final Return: n=3).

Users can understand WalkFund’s core idea: Walk to Save, with 80% accurately re-describing it.

Iteration Principle: reducing choice complexity at the moment of action, making progress feel automatic and reassuring.

Challenge 1: Hidden and Hard-to-Find “Add a Goal” Entry

Round 1 testing (n=9) revealed that users struggled to begin one of the app’s core actions: 6/9 users couldn’t find Add a Goal (buried too deep).

Change: Moved Add a Goal to homepage; Added a second entry in Savings; Surfaced balance earlier

Result:

Find the “Add a Goal” button improved (Avg): 1m14s (Round 1) → 60s (Round 2) → 15s (Final Return).

Round 2 users (n=9) and Final Return (n=3) described the interface as clearer and aligned with expectations.

Challenge 2: Clarifying Savings vs. Digital Coins

From the Round 1, 6/9 users were confused by “Savings vs. Digital Coins (original ideas for the rewards),” which increased cognitive load.

Change: Removed Digital Coins → focused on walk-to-save ; Simplified naming + structure

Result:

Round 2: Users described the interface as clearer, more direct, and aligned with expectations.

No further conceptual confusion reported

Challenge 3: Non-intuitive goal-setting flow

55% of users (Round 1, n=9) rated the original goal-setting flow confusing or unintuitive, citing friction and unclear steps.

Change: Streamlined the flow by merging scattered settings into one simplified flow and reduce cognitive load.

Result:

Task time 64%↓(Avg): 62s (Round 1) → 12s (Round 2);

55% (Round 1) confusion → 100% ease (Round 2, 6/9 Easy ↑ and 3/9 Very Easy ↑↑)

Hi-Fi Mockups

Brand and Icon Design

Icon Grid and Base Size

Icons are designed on a 24×24 grid with a 20×20 visual container.

Stroke Logic

Primary strokes use a consistent base weight, with selective optical adjustments for dense or curved shapes to maintain visual balance.

Usage Sizes

Optimized for UI navigation and feature indicators at 18 - 40px.

Outcomes

Across the usability test with 18 participants with Figma and remote with Useberry. (Round 1 n=9, Round 2 n=9, Final Return n=3).

I focused on removing friction and observing how small design changes shaped user behavior over time.

Takeaway

Friction wasn’t a setback. It was the signal.

Early tests revealed friction and confusion, which helped me shape each iteration’s direction. This project reinforced a core product principle: clarity, simplicity, and a focus on key behaviors matters more than adding complexity.